For the first three quarters of 2019, Shaperfunds generated a total return of 18.40% versus 20.55% for the Standard and Poor’s 500 Index and 16.96% for the Total World Stock Index.

Since the beginning of 2015, Shaperfunds generated a total return of 69.22% versus 61.83% for the Standard and Poor’s 500 Index and 42.71% for the Total World Stock Index. Note, all returns are adjusted for dividends.

2019’s performance has been heavily influenced, again, by the largest holding, Tesla (TSLA).

Here is a chart of Tesla so far in 2019:

Tesla is down 1.4% year-to date, yet it’s attributed to much of my outperformance.

I bought TSLA stock hand over fist as it began to fall precipitously in early 2019. I increased size the position from ~14% of the portfolio to ~24% of the portfolio in May 2019. See the trade history below:

As of 10/25/19, Tesla is only 18.76% of the portfolio.

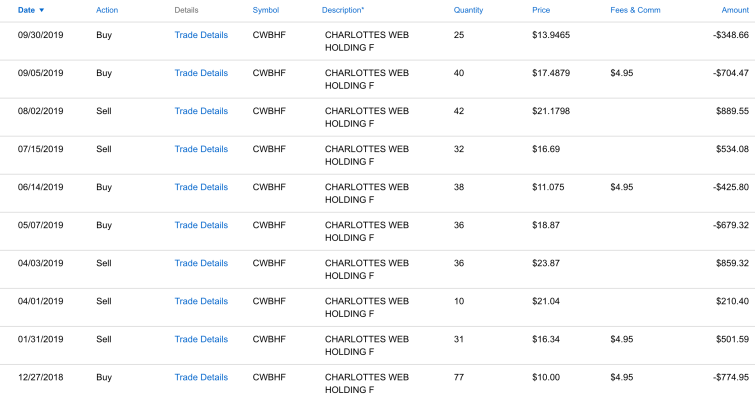

Another position with a large positive impact to performance is Charlotte’s Web (CWBHF). Charlotte’s Web is a very well managed Hemp producer and consumer packaged goods company based in Boulder, CO. Historically they were just a family operation but it recent years, in anticipation of the 2019 Farm Bill, they aggressively hired a slew of pedigreed executives to grow the company quickly. They’ve managed to maintain profitability which is remarkable given the investments they’ve made.

I’ve already banked $61 and the entire current position is also just gains thanks to some fortunate short-term contrarianism:

I rode CWBHF for nearly 100%, twice this year. It was a small position so the gains weren’t year changing, but helpful in beating the benchmark.

Here’s an update on valuations around the world:

- S&P 500 Index Price/Earnings Ratio: 22.5

- FTSE Developed ex US Index Price/Earnings Ratio: 14.2

- FTSE Emerging Markets Index Price/Earnings Ratio: 13.3

Shaperfunds consists of 59% US Stocks and 39% Foreign Stocks. The opportunity in the next decade lies in foreign markets. I’m still working to get to a 50/50 allocation of US stocks to Foreign Stocks, especially as I trim Tesla.

Three investments I’m particularly excited about are BASF (BASFY), the German chemical producer, Linde (LIN), the British industrial gas company and Volkswagen (VWAGY). The uncertainty around Brexit and low commodity prices have led to low valuations in high quality European giants.

The portfolio position with the largest negative impact to performance in 2019 has been Spotify Technology (SPOT), the Swedish music and podcast streaming company. I’m very bullish because of Spotify’s network size advantages and large consumer surplus. Spotify now boasts 248 million monthly active users (MAUs) and 113 million subscribers, with its paid user base growing 31% year-over-year. For comparison Apple has ~60 million MAUs, and Amazon has ~32million.

Spotify’s vast social web of artists and music/podcast consumers is their moat. They can negotiate better terms with artists because their streaming counts are far greater. Apple and Amazon pay artists more per stream. For them, there’s no new equilibrium without running an operating loss.

Also, the unique social aspect of Spotify means their curation algorithms are very fine tuned. Spotify predicts what we want to listen to. Spotify is a special product and a special company. I think they can be a multimedia giant.

Here is the composition of Shaperfunds as of close on 09/30/19:

18.76% TSLA Tesla Inc

10.77% VWO Vanguard Emerging Markets Stock Index

7.54% GOOG Alphabet Inc Class C

6.95% SPOT Spotify Technology SA

5.89% BRK.B Berkshire Hathaway Inc. Class B

5.17% AXP American Express Company

3.50% AMZN Amazon.com, Inc.

3.44% EA Electronic Arts Inc.

2.42% AMGN Amgen, Inc.

2.29% BASFY BASF SE

1.72% CWBHF Charlotte’s Web Holdings Inc

1.72% VWAGY VOLKSWAGEN AG/ADR

1.69% TWTR Twitter Inc

1.65% MMM 3M Co

1.61% GWPH GW Pharmaceuticals PLC- ADR

1.59% LYFT LYFT Inc

1.56% DIS Walt Disney Co

1.55% LIN Linde PLC

1.49% CRM salesforce.com, inc.

1.47% AAPL Apple Inc.

1.45% TCEHY TENCENT HOLDING/ADR

1.44% GIL Gildan Activewear Inc

1.36% SMG Scotts Miracle-Gro Co

1.35% CRSP Crispr Therapeutics AG

1.32% XYL Xylem Inc

1.24% BCS Barclays PLC

1.14% ALK Alaska Air Group, Inc.

1.08% BBVA Banco Bilbao Vizcaya Argentaria SA

1.03% BIDU Baidu Inc

0.92% ZEN Zendesk Inc

0.91% BLK BlackRock, Inc.

0.90% NVTA InVitae Corp